Affordable Insurance

Insurance to fit your business

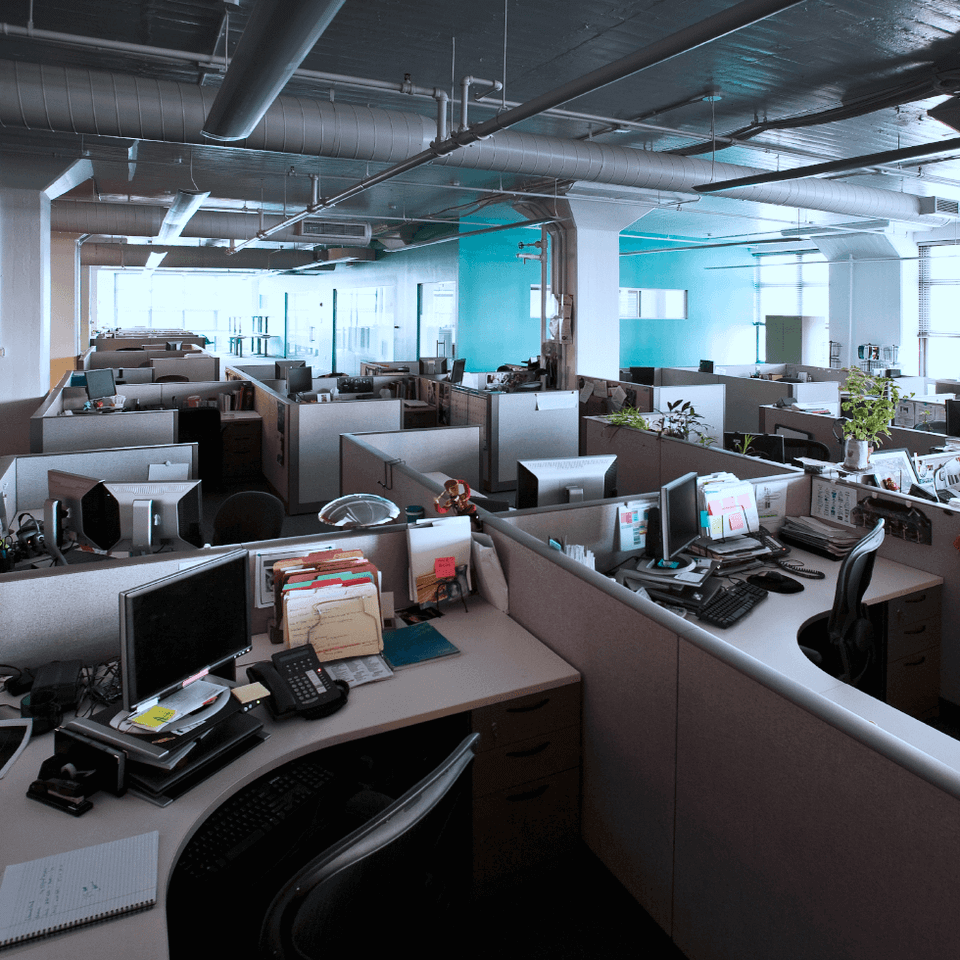

Your office space should be included in your property insurance to cover your losses in the event of an accident. No matter what type of business you run, you need to protect your assets and finances with insurance coverage.

A mistake or accident (which is guaranteed to happen at some point) can cost businesses larger sums than expected. Unfortunately, thousands of businesses have to shut their doors every year because of the financial burden.

Almost every industry, from doctors to grocery stores to antique shops, needs insurance coverage to fit your exact business situation. Talk with a professional and experienced insurance agent to get a quote for your business. We look at your current situation and write the best policy possible at the most affordable price.

A mistake or accident (which is guaranteed to happen at some point) can cost businesses larger sums than expected. Unfortunately, thousands of businesses have to shut their doors every year because of the financial burden.

Almost every industry, from doctors to grocery stores to antique shops, needs insurance coverage to fit your exact business situation. Talk with a professional and experienced insurance agent to get a quote for your business. We look at your current situation and write the best policy possible at the most affordable price.

Get insurance for your owned or leased office

Commercial property insurance for your business

Work with an affordable and trustworthy insurance company

Insurance coverage for your physical location

If you own, run, or manage an office, it's vital that you take steps to protect yourself, your employees, and your business from harm. No matter your industry, taking action to avoid trouble will work wonders for your long-term success and profitability. The type of office insurance that you get will depend on several factors, and a dependable agent can help you find something that works for you.

Your insurance coverage should be adjusted to fit exactly what your business needs. If you own multiple locations, you can get coverage for all of the physical locations under the same policy.

Your insurance coverage should be adjusted to fit exactly what your business needs. If you own multiple locations, you can get coverage for all of the physical locations under the same policy.

- Protect your business and your employees

- Get coverage for multiple offices and locations

- Insurance that fits your needs, no matter how large or small

Get started today

If you are ready to get started so that your office is prepared for the unexpected, you can contact our team for information. We will walk you through the steps, and you won't need to worry about making the wrong choice. Once we get to know you and your needs, we will craft a policy on which you can depend.

What is office building insurance?

Office building insurance is generally written on a business owners policy (BOP) for smaller businesses. Depending on the size of the building, you may need to put it on a commercial package policy. The policy can include a variety of different coverages. Small business owners should protect themselves with the appropriate insurance package.

What insurance coverages are typically needed for an office building?

- Property

- Liability

- Umbrella

- Workers’ compensation

- Equipment breakdown

- Crime

Our agents can build an office building insurance policy that only includes what you need.

What is the cost of office building insurance?

Generally speaking, an office building will typically be charged based on the size of the building and type of occupant of the building. The other factors would be:

- Age of building

- Construction of building

- Updates on the building

- Safety measures

- Security of the building

- And more

What types of businesses need office building insurance?

The list can go on and on. Almost any professional office needs insurance for full coverage. We've listed a few common types of businesses with offices that need coverage.

Are you ready to talk with a professional? Get a FREE quote when you talk with one of our agents.

- Insurance agency office

- Real estate office

- Doctor’s office

- Dental office

- Accounting office

- Attorney’s office

- Surveyor’s office

- Appraiser’s office

- Other professional offices

Are you ready to talk with a professional? Get a FREE quote when you talk with one of our agents.

Is there a way to reduce the premium on the insurance on an office building?

Yes. Here are a few ways to reduce your insurance payments on your office building:

- Create and keep a safety manual for the building

- Schedule regular maintenance for the building

- Keep an alarm system for the building that is up to date

- Invest in security for entering or exiting the building (or even security guards)

- Consider options for coinsurance (and understand what could create a coinsurance penalty)

- Choose higher deductibles

- Select a building type favored by your insurance company

Do you have a question about Office Insurance?

Our agents are ready to answer any of your questions.