Builder's Risk Insurance

Get affordable builder’s risk insurance

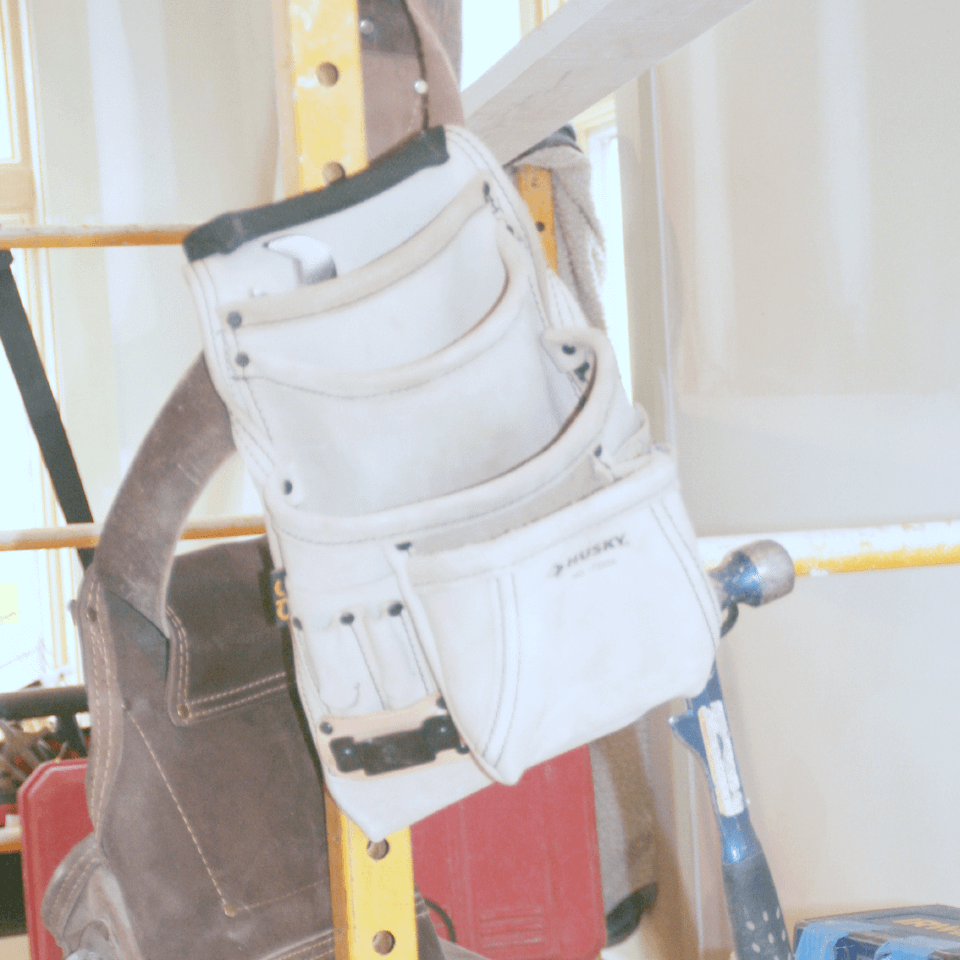

Whenever a builder starts a construction or renovation project, he knows that it carries some risk. For even the most seasoned contractors, finding affordable builder’s risk insurance can be intimidating. With good builder’s risk insurance coverage, you can have peace of mind that even if something goes wrong you have the policy to protect you.

An insurance company can help protect you in the event of:

An insurance company can help protect you in the event of:

Any type of damages to your property

Theft of equipment from a construction site

Property damages from unexpected weather

What could be covered by Builder’s Risk Insurance?

Many of our clients are not sure what to expect from their policies when it comes to specific covered events. Typical builder’s risk insurance policies will cover one or more of the following:

Theft: Construction materials are often expensive, and having them stolen could put a nasty kink in even the best plan. Reimbursement for the theft of your materials ensures that your project will remain profitable.

Project sites: Your policy can cover new construction sites, time frames on the build itself, materials, fixtures, and other equipment being used in the construction.

Fire, weather, and other natural disasters: Many places have severe weather, and your community is no exception. Damage from severe weather, fire, and other natural disasters costs billions of dollars annually in the United States alone.

Theft: Construction materials are often expensive, and having them stolen could put a nasty kink in even the best plan. Reimbursement for the theft of your materials ensures that your project will remain profitable.

Project sites: Your policy can cover new construction sites, time frames on the build itself, materials, fixtures, and other equipment being used in the construction.

Fire, weather, and other natural disasters: Many places have severe weather, and your community is no exception. Damage from severe weather, fire, and other natural disasters costs billions of dollars annually in the United States alone.

Work with professional insurance agents

Our experienced agents work closely with you to calculate your job's likely risks and help you find the right policy to match your needs. If you're starting a project soon and thinking about purchasing coverage, we can diligently help you get all the coverage you need. Don't wait until it's too late to protect your assets.

For more information, please contact our experienced team of agents for builder’s risk insurance and installation insurance.

For more information, please contact our experienced team of agents for builder’s risk insurance and installation insurance.

Does builder's risk insurance have any liability coverage?

Builder’s risk doesn’t include liability insurance. It provides property coverage on the construction project, the building or structure, and your equipment. How much property it covers will be dictated by how the policy is set up. You can get liability or workers’ compensation coverage from other policies.

Builder’s risk insurance covers:

- The building materials on the property

- Your equipment from theft

- Fire or storm damage to supplies

It does NOT cover:

- Someone walks into your project area and trips on equipment, breaking a wrist

- A 2 by 4 with nails breaks and falls onto a worker, hitting their back

- Other accidents that someone could claim you're liable/responsible

What should be included for the construction cost on a builder’s risk policy?

The construction cost reported on the builder’s risk insurance should include all labor, construction, and management fees. You should also include materials, equipment, machinery, and supplies that will be used in the construction and will become part of the completed project.

- Labor

- Construction

- Management fees

- Materials

- Equipment

- Machinery

- Supplies

Should demolition be included in construction costs?

No. Since the property you are demolishing is not going to be repaired or replaced, it should not be included in a builder’s risk policy. Insurance is used to cover the cost to replace something that could accidentally be damaged. If there is no intention to use that property, and it's going to be destroyed, it's a waste of money to ensure a building you're going to intentionally destroy.

When does builder's risk insurance begin?

Coverage begins on the estimated start date for the construction work that is specified on the application and designated by the insured or project manager. This should be the same date that work is scheduled to begin on the site and doesn’t need to be during the demolition phase.

What if a construction project goes past the estimated date of completion of work?

Just make sure to keep your insurance agent informed of the expected completion date. They can ask for an extension on the policy or they can re-write another policy that will extend the date out for you. Either way, with proper communication, our agents can work with you to get exactly what you need.

Do you have a question about

Builder's Risk Insurance?

Our agents are ready to answer any of your questions.